Has your Investment Manager told you that the best option right now is to “ride-it-out?” Mine has. Most of us have probably heard this recently, maybe in different words but still the same concept. Why is he so calm and why is riding it out so hard?

THIS TIME IS NOT DIFFERENT

First, he’s calm because he’s been through this before. It is, in fact, NOT different this time, though the media really wants us to believe it is. Market pull backs are an ordinary and recurring action. Some people even welcome them as opportunity. Opportunity to buy equities at ‘sale’ prices. Opportunity to move funds from a conservative asset to a less conservative asset to take advantage of the market rebound that is on the horizon. Yes, he’s calm because he has over 100-years-worth of data and all his years of personal experience that say ride-it-out.

Second, riding it out is hard because we are human and humans are naturally emotional beings. There’s a saying about people and the S&P – it is almost 100 years old (dating back to 1923) and has never failed, the only failures have been human failures. So don’t fight the emotions, just try to accept them and hold on. Maybe your grip is tight and your nails are digging in, that is ok. Whatever it takes to avoid a market timing misstep.

TIMING COMES WITH CONSEQUENCES

Timing the market is tough and missing the mark comes with consequences. The problem is that the consequences aren’t necessarily an in-your-face flashing screen that says you missed out. You may not realize just how uneventful it is to miss.

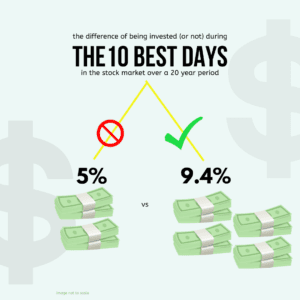

Take an investor that missed the 10 single best days in the markets between 2001 and 2021. This may seem unlikely to you. If you believe in timing the markets, you may believe that you would always be invested during those great times. However, a lot of timers pull their money out when times are tough and don’t put it back in until the markets are stable again. So, it is important to know that in that 20 year period, seven of those best days happened within about two weeks of the 10 worst days.

That is crazy important so I’m repeating it – Seven of the 10 best days in the 20 year period were within two weeks of the 10 worst days. It must be incredibly difficult to shove your money back in the markets so close to one of the worst days in 20 years. I know it would be hard for me.

The investor that missed the 10 single best days in the markets, has missed out on more than 4% of Year over Year returns……think about that. 4% every year, compounded. The average annualized return for the investor that rode-it-out was 9.4% and the investor that timed the markets and missed seven of the best days averaged 5%. That’s a big blow to a retirement account, a nearly 50% difference.

ADAMS INVESTING TAKEAWAY

The markets tend to right themselves before risks and global events pass. Remember the markets are built on companies whose only goal is to make money. Collectively, they will always find a way to be profitable, no matter what challenges are in their path. Take a look at your neighbor’s front porch, are Amazon boxes still showing up? The drive thru lines at Starbucks still seem to be full. The point is, companies are still making money – sometimes a little more or less but still making money. This leaves only one thing for us investors to do: Ride-It-Out.

You work hard for your money, is it working hard for you? Find out in less than 5 minutes

Blog written by House Writer

House Writer is not a registered investment advisor or broker/dealer and does not make security recommendations nor provide financial advice. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult their personal tax and/or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.