A comfortable and worry-free retirement is the goal of many Americans. However, the biggest obstacle in attaining retirement goals is that people may tend to procrastinate and avoid thinking ahead to formulate a plan of action. As a result, many are left scratching their heads, with little time on their side. How will they attain the funds needed to enjoy their retirement years?

Whatever your age, it is never too soon to look ahead and begin giving thought to your retirement. Planning for retirement has become a more difficult task. Therefore, it’s important that you plan well in advance by setting goals and deciding how they will be met.

Our Process

Through our partnership with Riskalyze we’ll utilize cutting edge technology to identify your acceptable level of risk and reward. We’ll ensure your portfolio defines your investment goals and expectations and aligns with your retirement goals.

Together we can take the guesswork out of your financial future.

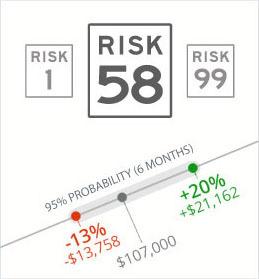

Capture Your Risk Number

The first step to answer a 5-minute questionnaire that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. Then we’ll pinpoint your exact Risk Number to guide our decision making process.

Align Your Portfolio

After pinpointing your Risk Number, we’ll craft a portfolio that aligns with your personal preferences and priorities, allowing you to feel comfortable with your expected outcomes. The resulting proposed portfolio will include projections for the potential gain and losses we should expect over time.

Define Your Retirement Goals

We will also review your progress towards your financial goals by building a Retirement Map.

When we are finished, you’ll better understand what we can do to increase the probability of success.

Risk Number

Sample Retirement Map

Investment Amount

$45,000

Monthly Savings

$1,000

Retirement Year

2037

Monthly Withdrawal

$4,700

Needed by Retirement Date

$853,800

Disclosure: All investing involves risk, including possible loss of principle. No investment strategy can guarantee a profit or protect against loss.

Come On Let's Go!

Get started today. Click the “Get My Risk Number” button below and find out your personal risk number, it’s FREE. With just a minute of your time you could unlock the unlimited potential of your financial future.