The last year or two we have seen extraordinary jumps in real estate prices. A lot of people made good money selling their homes. We were also lucky enough to be able to take advantage of this. We sold our “dream home” for more than twice what we built it for eight years earlier. It was sad to leave but we decided to build a new home on land and we are excited for the new adventures.

LIFE IS FULL OF TRADE OFFS

As you may have guessed, building a new home is a lot more pricey now than it was eight years ago, or even two years ago for that matter. We have found that we are at a cross roads with spending. We can spend all our proceeds from the last house and our new house will be built and finished the way we want. Or we can spend less on the new house (unpaved driveway, smaller horse barn) and invest a portion of the proceeds into our retirement.

TIME IS MONEY

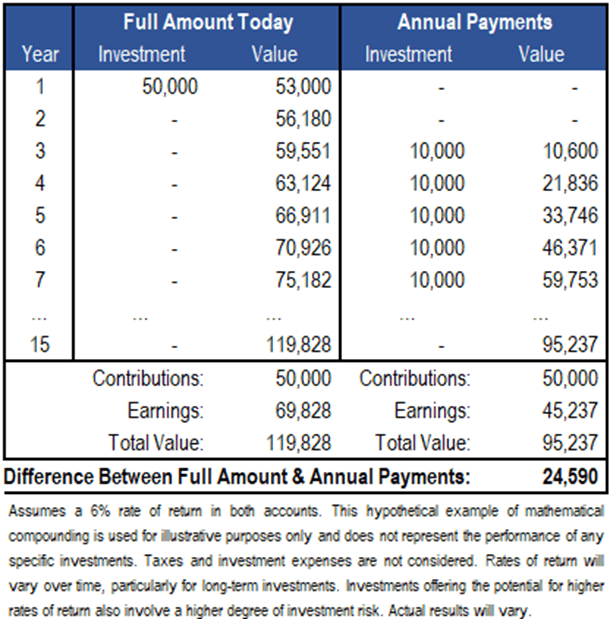

We could invest $50,000 today or we could save $10,000 per year for 5 years (starting a year after the house is done). One option sets our retirement up for success and means we will have to slowly work to complete those unfinished parts of our build. The other option provides instant gratification with a perfect new home and we will have to save in the following years to fulfill our retirement goals. Let’s assume an average annual return of 6% for both options.

After 15 years, investing a total of $50,000 in both accounts and assuming the same average rate of return, one account shows a significantly higher total value. Because of compounding, the Full Amount Today account is almost $25,000 higher than the Annual Payments account. That is a huge difference just for investing early and allowing the compounding to do its thing. Imagine the accumulation after 20 or 30 years and the impact that starting early has!

ADAMS INVESTING TAKEAWAY

At the end of the day, this ends up being a very personal decision and preference. As with almost everything in life, if you choose something, you have to give up something. In this case, is your retirement more important to you or is it more important to finish your home accessories. No wrong decision but if it is retirement, we can help.

Blog written by House Writer

House Writer is not a registered investment advisor or broker/dealer and does not make security recommendations nor provide financial advice. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult their personal tax and/or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.