Most of us are short on time. That’s why we’re shelling out more and more money for items that save us time and effort…sometimes without even realizing it! There’s a great quote that’s attributed to

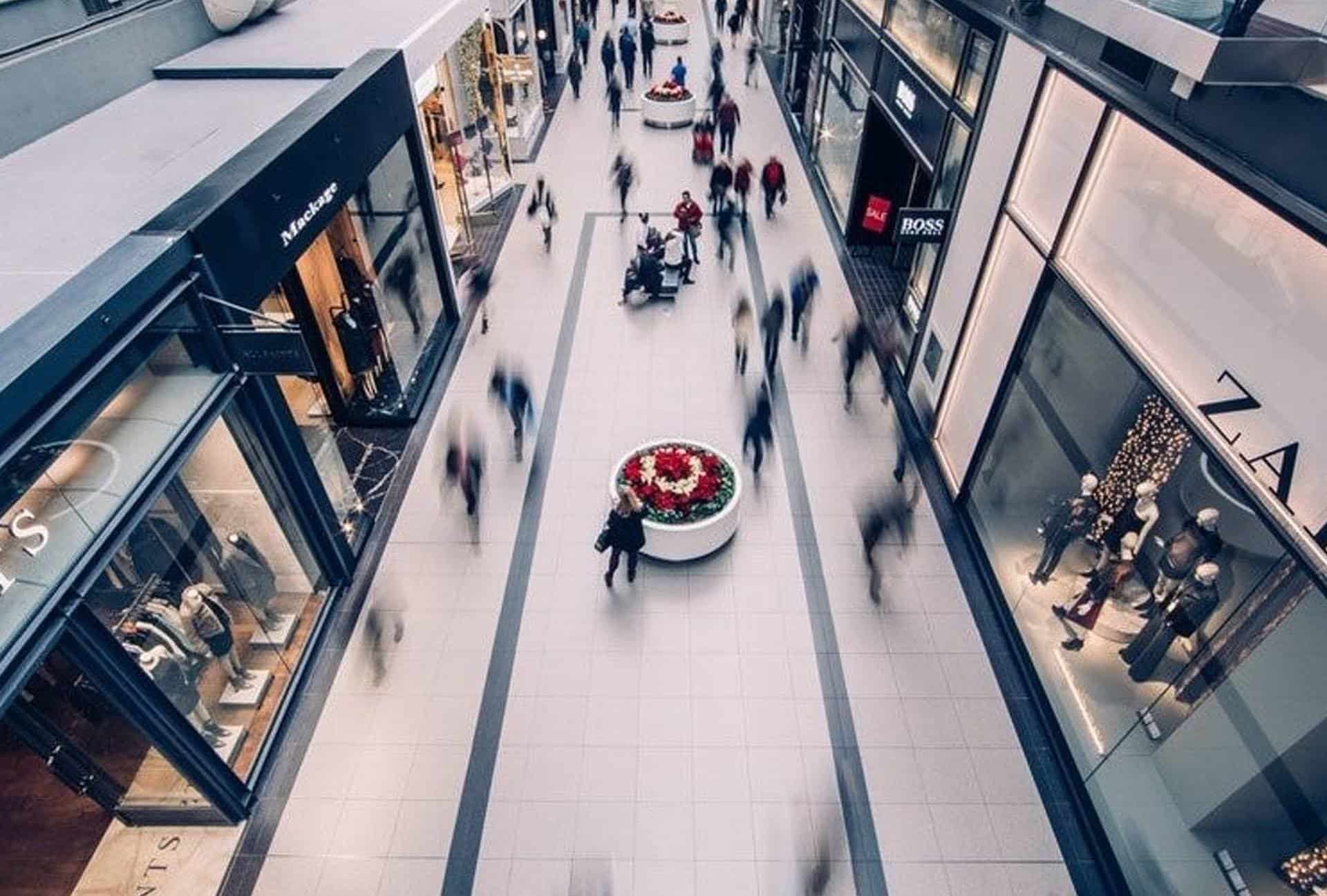

Are we convenience crazy?! 15+ ways that you spend on convenience.