I recently had a call with a client who is a small business owner. He started his business a few years ago from nothing. Through hard work, dedication and cultivating great relationships, he has built the business into something very impressive. This year he is planning to double his business operations and more than double profits. He has literally built the American Dream and is living it every day.

SOLVING A SPENDING PROBLEM

He said something to me that I’ve heard before, yet it still caught me. He said “I’m going to have to spend a lot of money next year so that I don’t have to pay the government so much.” Ah taxes! Yes, taxes.

I asked this somewhat new business owner if he had considered opening a SEP (Simplified Employee Pension) plan for his company. It could help with his “spending problem,” which is an uncommon, yet good problem to have. The contributions are tax deductible on the business return and it pushes pre-tax funds to your retirement accounts. Win-win? I think so.

SEPs ARE SIMPLER, CHEAPER, FLEXIBLE

From a setup and maintenance perspective, the SEP is fundamentally simpler, cheaper, and more flexible than other retirement plans, such as 401Ks. Contributions are made to an IRA account that is setup for each plan participant (note: the participant sets up the account, not the business owner – another win for those small business owners wearing all the hats and working long hours).

For our company SEP Plan, my accountant provided the one-page form to open the plan. I chose the plan options, signed, and submitted. Now all I do is calculate the SEP amount each year and write a check directly to my (and my employees) SEP-IRA accounts. I hand the check to the employee and allow them to make the deposit. It is that simple. Not only is my retirement account happy, but my employees are happy and feel appreciated.

PRE-TAX INVESTING OPPORTUNITY

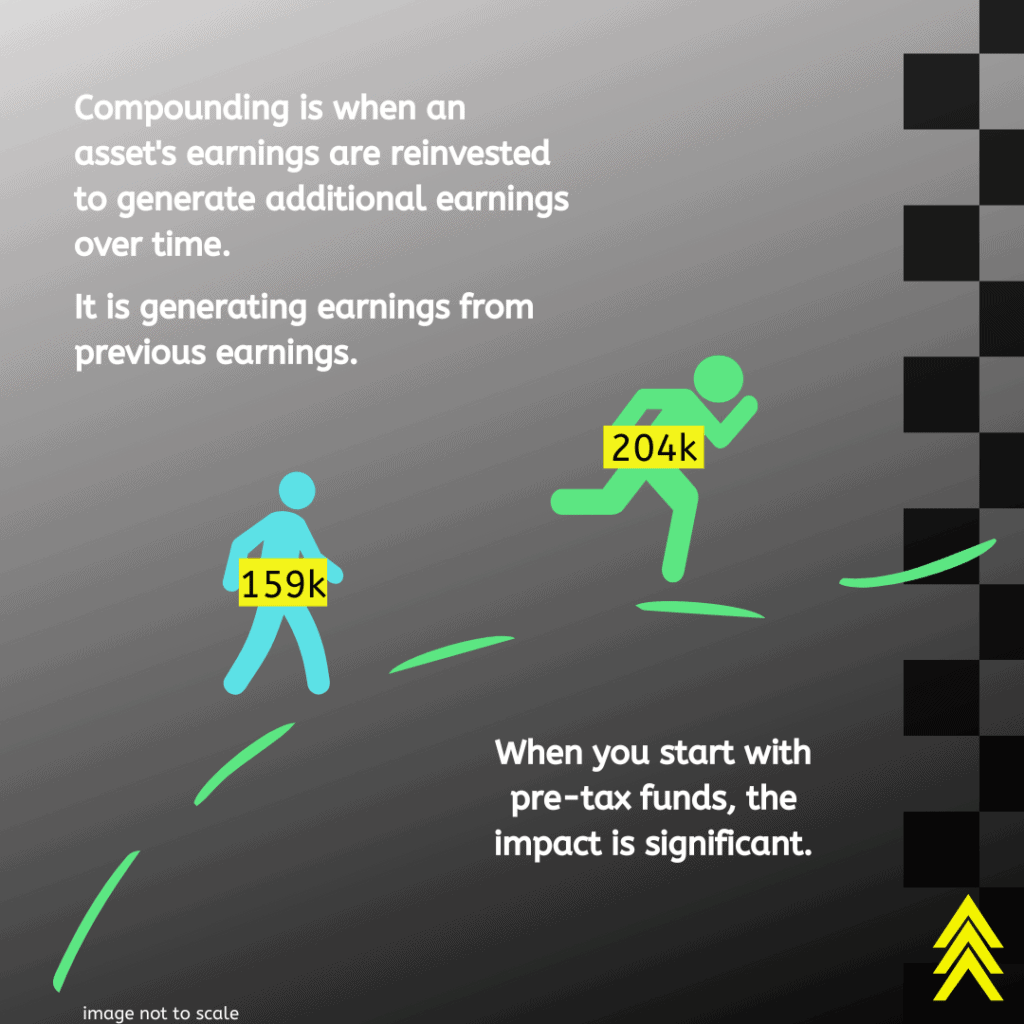

The participants are getting money that has not been taxed. This money goes into an investment account and grows untaxed until they retire. When they start making withdrawals in retirement, income tax is charged. We talk a lot about compounding in these blogs (blog: compounding & coffee) and this is a great example of it. The retirement account has a compounding advantage because it is starting with untaxed dollars and has the time to do what compounding does best. Let’s look at the difference:

$10,000 pre-tax, invested, grows at 9% for 35 years ==> $204,140

$10,000 taxed means $7,800 invested, grows at 9% for 35 years ==> $159,229

The difference is $44,911 and that is only the first of (hopefully) many future SEP payments. Compounding is fire (as the kids say) but it needs time to work. Take full advantage of it at every possible opportunity. This is a nice opportunity that Uncle Sam has offered.

THE NITTY GRITTY DETAILS

- *Deadline – You can setup a SEP plan as late as the due date of your business’s income tax return for that year. So, you can still setup a plan now (Februaury 2023) to participate in 2022 contributions.

- * Participation – Employee Eligibility has flexibility in options to choose (who is eligible and when)

- * Contributions – Most common is paying a percentage of participant salary but you can also set a flat amount. It cannot exceed the lesser of:

- –25% of compensation or$66,000 for 2023 / $61,000 for 2022

- –Self-employed may use a special calculation (see IRS site linked below)

- * A SEP-IRA is a traditional IRA and follows the same investment, distribution, and rollover rules.

- * Plan – There is quite a bit of flexibility in creating the plan and it can be changed quite easily in the future.

ADAMS INVESTING TAKEAWAY

SEP plans make sense for a lot of reasons but especially if you have a big profit to ‘burn’. Take care of your retirement and make your employees feel valued and appreciated while getting the tax deduction your company needs. The setup and maintenance is much easier than you think.

For more information on SEP Plans from the IRS, click here .

Author is not a registered investment advisor or broker/dealer and does not make security recommendations nor provide financial advice. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult their personal tax and/or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal.