By: Shanon Adams

Note: Shanon Adams does not make security recommendations. The below article simply represents a theme we wish to highlight.

Crypto currencies are dominating headlines lately. I can’t remember something this big since Friends started on TV. It seemed like everyone and their brother was watching. Of course, I was too! I didn’t want to miss out and I don’t want to miss out on the crypto rush either. So I bought a small amount thru PayPal earlier this year. It’s doing well and fine and it has been an interesting experience.

Uncle Sam Is Eyeing Your Crypto

Today in PayPal I got a notice.

Tax Payer Status? For Crypto? The only reason I can think they need (or want) that info is in regards to taxes. But taxes on a cryptocurrency?

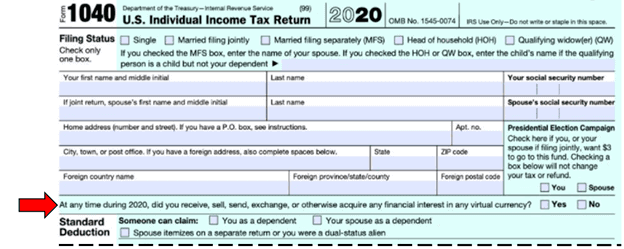

During tax season, my accountant asked me a long drawn-out question about buying crypto last year. My answer was no because I was filing for 2020 and bought my crypto in 2021 but that was a very specific question. Both of these ‘clues’ made me think the IRS has put crypto on their tax radar so I dove in to research it.

The answer is yes, the IRS is ramping up their oversight of crypto. They have made some big moves recently to be sure they get paid the taxes they feel they’re due.

Here’s the question my accountant asked… it’s on the FIRST page of the 1040 form for 2020, just below name and address. That’s some prime real estate and it likely means they’re serious. I don’t think you can claim you didn’t see the question.

Is Crypto a currency or asset?

The other move they made recently is defining crypto as an asset / investment property like stock shares or real estate, not a currency. This is big because it means that sales proceeds will be taxed as long- or short-term capital gains, and losses can be used to offset gains.

If you buy a sandwich – or a car – with bitcoin, it isn’t like using cash. The transfer may trigger a taxable gain or loss, the same as a sale of stock would, and tax could be due on any gains of that sale (of bitcoin, not the sandwich).

The Crypto Transactional Headache

This is super interesting to me because the government is saying they don’t recognize cryptocurrency as an actual currency but more like a commodity? While this impacts me and my mini account marginally, it will have massive ramifications on businesses being able to accept crypto. Every transaction would complicate the company’s own tax situation; each one would have a different cost basis to be tracked against the company’s own crypto stake. It sounds like a big headache, and that’s coming from someone who loves a good paperwork processing challenge. Anyway, it seems to me like this definition of crypto could slow its growth and future use by big corporations. Could this be why Tesla mysteriously pulled the plug on accepting Bitcoin? So many questions…

Do I have to pay taxes on my crypto?

One thing has become clear though, Uncle Sam is eyeing your crypto account. He’s even sending letters to Americans with offshore crypto accounts and issuing summons to crypto exchanges requiring them to turn over customer records. I know how I’ll answer the accountant’s questions going forward as I don’t want to end up on the Tax Man’s wanted list.

RESOURCES

https://www.irs.gov/pub/irs-pdf/f1040.pdf

Try Out Our Retirement Calculator

Have you heard the saying “the hardest part is getting started?” Every day you delay could be money left on the table and increased chances of outliving your money. Ultimately, our retirement calculator will give you a rough idea if you have enough to retire and if you don’t yet, we give you some options to get there. It takes less than a minute and the results are instant.