We’ve got answers

Are you nearing retirement and worried how you’re going to handle your large 401(k) balance? One great thing about a 401(k) retirement savings plan is that your assets are often portable when you leave your job or retire. But what should you do with them? A 401(k) rollover to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances.

How much risk should you have?

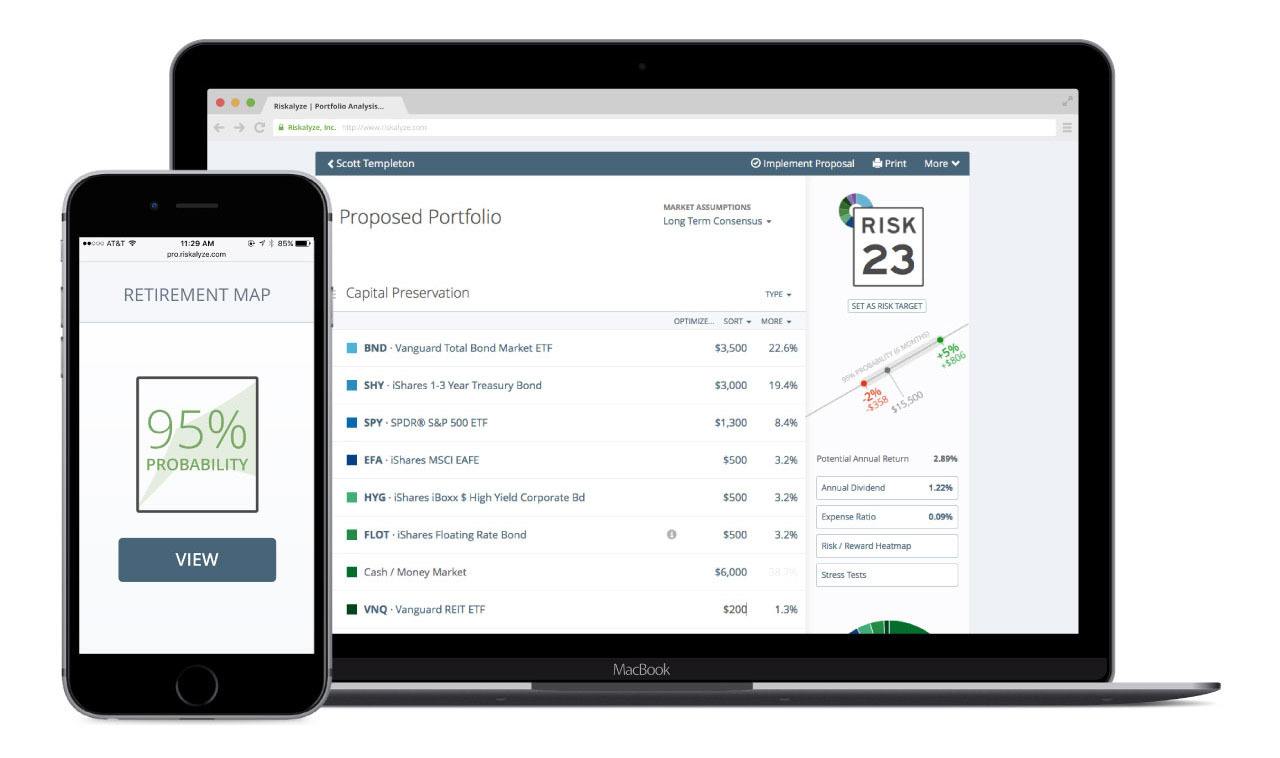

We’ll use all these factors to build an optimized portfolio that fits your risk tolerance and goals. We can then stress test your new portfolio, discuss your 95% probability range, and set expectations fro the future!

The stress-free solution

When you left your job did you leave your 401(k) behind? We make a 401(k) rollover easy from an old workplace retirement plan to a Charles Schwab IRA professionally managed by Jarrod Adams Investing. Get started today, click the “Get My Risk” button below and find out your personal risk number. You’ve got nothing to loose, it’s FREE!